The VFEX, or Victoria Falls Stock Exchange, is Zimbabwe’s exclusively US dollar only stock market. Immediately after the exchange was launched in 2020, VFEX attracted attention, as it offered listed companies exemptions for capital gains taxes and, most importantly, the ability to repatriate 100% of their US dollar earnings. As a result, the Zimbabwe Stock Exchange, or ZSE’s mainboard in the capital of Harare, was shrinking in the past years because of companies that migrated to VFEX. Companies in Zimbabwe constantly experience a shortage of foreign exchange.

In particular Padenga’s decision to list on the Victoria Falls Stock Exchange in 2021 was considered a boom for the new exchange and the government’s incentive scheme. John Legat, CEO of Imara Asset Management, the country’s largest broker, rightly commented, that the decision of Padenga to list on VFEX deprived local investors from a good stock, and could lead to an exodus from the Zimbabwe Stock Exchange. Legat called for the Government to give the same incentives to companies to list on the ZSE.

In its Exchange Control Directive RY002/2023, the government of Zimbabwe increased export retentions at 75% across all industries, including companies listed on VFEX. The balance of 25% of the export proceeds must be sold to the Reserve Bank at the prevailing interbank market rate. In the words of the famous Maori legend, VFEX lost its wings, if it ever had any.

Desperate governments take desperate measures. According to the World Bank, foreign reserves (ex gold) in Zimbabwe was reported at USD $434,674,310 in 2022.

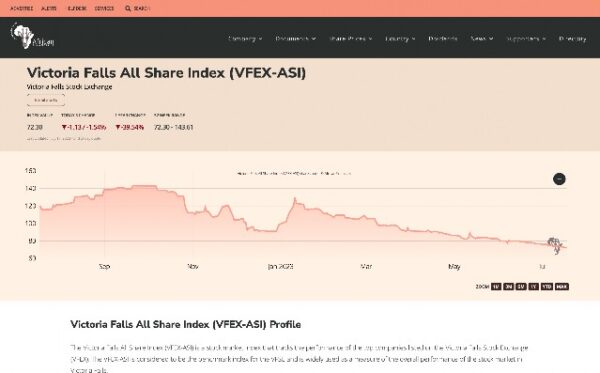

VFEX never was a capital market innovation. Instead, it was a regulatory safe haven. There have hardly been any real offerings to raise capital on VFEX. As the below figure, published by African Financials illustrates, the VFEX-All Shares Index has lost 39.54% YOY. We project this trajectory to continue. Most global investors will wish to avoid the trappings of a small, highly illiquid exchange with heavy-handed exchange restrictions.

The ZSE has fared better in the face of adversary, as shown in the figure below. The depreciation of the Zimbabwe dollar against the US dollar has kept the growth in market cap of ZSE stagnant for a long time. To give but one example: in March 2023, the ZSE grew 36%, bringing market cap up to $3.36tn from $2.4tn in February 2023.

Promising as that may sound, the local Zimbabwe currency depreciated 34% in the same month, as a result performance in real terms was diluted to 1.5%.

Yet the ZSE does offer upside. Year to date growth has been 718.34%, and it is trading at a deep discount to fair value.

@ Brun Lubert Corporation – All Rights Reserved

DISCLAIMER: The information and material presented herein are provided for information purposes only and should under no circumstance be U. S. ed or construed as a solicitation or offering to acquire, dispose, or engage in any financial dealing, including but not limited to the buying or subscribing for securities, investment products, or other financial instruments, nor to constitute any advise or recommendation with respect to such securities, investment products, or other financial instruments. This Bulletin is prepared for general circulation and has no regard to any class of investor or the specific investment objectives or particular needs of any specific person which may receive this Bulletin. Readers should independently evaluate the information and material contained herein before making any investment or other decision, and should take appropriate independent financial advice before making any investments or entering into any transaction in relation to any content mentioned in this Bulletin. It is a violation of U. S. federal and international copyright laws to reproduce all or part of this publication by email, facsimile or any other means. This document is not for attribution in any publication, and you should not disseminate, distribute, or copy this Bulletin, either in whole or in part, without the prior written consent of Brun Lubert Corporation.

Publisher – BRUN LUBERT CORPORATION

Enquiries – BRUN LUBERT CORPORATION

667 Madison Avenue

New York NY 10065

United States

Editor – Ana Beysoylu

Tel. +1 212 823 6246

E. media@brunlubert.com

brunlubert.com